WHY SMALL BUSINESSES SHOULD HIRE A BOOKKEEPER

- Debbie Brown

- Apr 25, 2021

- 2 min read

Are you a small business owner drowning in paperwork?

Do you struggle with keeping track of your expenses and making payments on time?

Do you worry that the IRS is going to fine you for doing things wrong?

Are you losing income because you can’t keep up with collections from customers?

Maybe it’s time to hire a bookkeeper!

Free up time for building your business

Why did you start your business? Do you love the industry? Being your own boss? Or perhaps you simply love the ability to make money that is truly yours. Whatever the reason, small business owners quickly find that their once thriving product and passion is being diminished by the grind of the average day-to-day running of a business. Bills pile up or get lost, cash flow is a pain to figure out, and then at year-end everything is a mess just in time for filing taxes. With an efficient bookkeeper to handle the day-to-day paperwork, you as the owner are free to concentrate on your best asset, you. You will have more time to build your business and thrive. As a result the business is more organized and you can do what you do best.

So what does a bookkeeper really do?

Accounts Receivables - creating invoices of sales to customers and collecting payments.

Accounts Payable - creating bills to vendors for payment of expenses.

Payroll - creating paychecks for employees

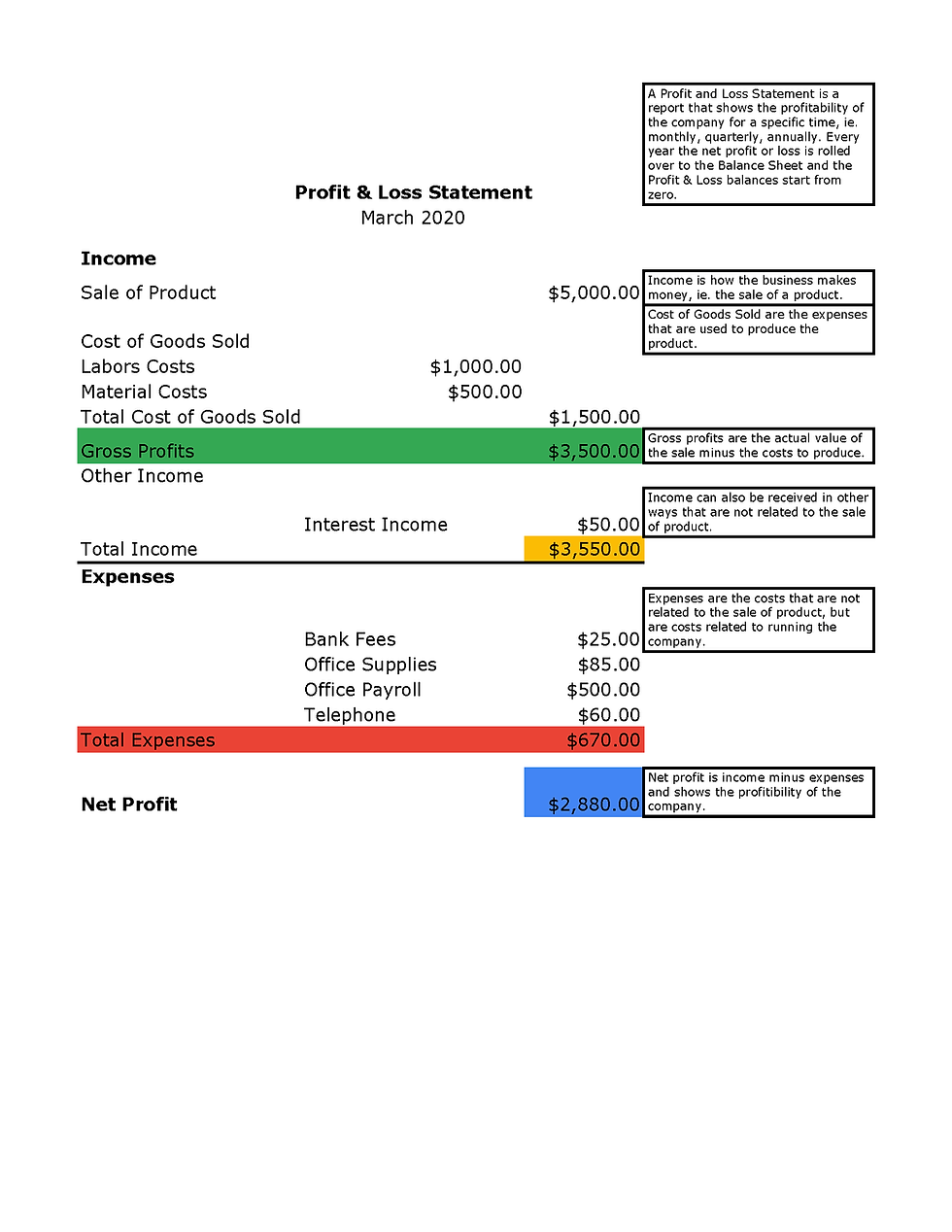

Financial reports - reports to track profitability of the company

Year End Tax Preparation - preparing documents for filing taxes

How much will it cost?

Average cost for bookkeeper $20-60 per hour

Average cost for CPA $150-300 per hour

As a small business owner, how much time do you spend doing the items listed above? An efficient bookkeeper will do things much quicker. Bright Business Services is an affordable service for small businesses. For example, a business with 2 employees, could require between 5-10 hours a month in bookkeeping services. This would amount to between $150-$300 a month depending on the work volume. This is a small amount to pay for less headache and expensive tax problems. Hiring a bookkeeper is much less expensive than hiring a CPA to do the same thing. Good records will decrease the time the CPA needs to spend doing the business taxes at the end of the year.

In today's world a small business doesn’t need a bookkeeper to come to their home office in order to keep things organized. Excellent accounting software is available online for remote access from any location. Payments can be made electronically, revenue can be collected electronically, and employees can be paid with direct deposit. No need to have piles of paperwork when electronic versions are more efficient. Contact Bright Business Services today to get your business organized and free you up for building your business.

Comments